When you hear a phrase about “financial affirmations” to gain financial independence and abundance, this may sound like a little woo-woo. However, upgrading your money belief can indeed sometimes work.

What is money affirmation?

Financial affirmation or you can call it a money mantra, is a statement you repeat time after time to shift your belief and make you more confident in reaching your financial goal.

Likewise, the notion is similar to the law of attraction, which means that if you focus on something positive, you’ll attract positive things and vice versa. This helps some people feel they have more control over their life, and that’s comforting.

Affirmations can break negative thought cycles in the short term. Over time they can become powerful. They may not necessarily work immediately because changing a deeply ingrained belief is often complicated and takes time.

But, a periodic repetition of financial affirmations can encourage your brain to take these positive statements. When you genuinely believe in something, your actions often follow.

Imagine that your mind is like the operating system on your phone. When you’re the operating system has glitches in the code, the apps on your phone may not run smoothly and slowly.

For example, I know some people who genuinely believe that having a lot of money is a bad thing. They never asked for more money, even though they deserved it, and stayed in the role for years. Others may genuinely believe they didn’t deserve to be paid more money. I was one of those people. I didn’t think I could make six figures and work fully remotely until I saw my friends do it.

Another example is when my friend said, “I am not good at budgeting. I feel like I have no power over my finance.” Does that sound familiar to you? It made me a little sad when hearing it. I wish I could change her belief system.

Those are the cases when the money belief doesn’t serve you and will likely hold you back. You want to discard this and replace it with something else that helps you make positive decisions.

Ultimately, incorporating a positive mindset into your belief about money can help you move forward. Most importantly, it can help you become resilient as challenges come your way.

Financial affirmations can help upgrade your money belief. When you upgrade your money belief, you reprogram your mind.

Do financial affirmations work? Can money affirmation manifest immediately?

Generally, an affirmation can work with a few conditions (listed below), such as consistently taking action (essential), keeping it authentic, and ensuring they are aligned with your core values.

But it is unlikely to work instantly, i.e., after you read the affirmation, you’ll suddenly find $100 in the bathroom the next day. If that’s your case, good for you!

Numerous studies show that self-affirmation works and offers many benefits, including decreased health deteriorating stress. One study shows that we activate the brain rewards center when practicing self-affirmation belief.

However, an affirmation can often have a negative effect when it conflicts with the belief you carry in your subconscious mind. More explanation is down below.

Listening affirmations can work for shifting your mindset to achieve your goal, but they are not magic pills that will work instantly without other prescriptions.

Why positive affirmation sometimes works and sometimes doesn’t?

Changing your belief system is a lot harder than you think. Sometimes it may take intense and frequent repetition. You may have to reprogram a lifetime of outside voices, failures, and subconscious biases that support the negative affirmation you seek to lose.

In some cases, working with a therapist may actually be necessary (such as through CBT therapy) because they can help you untangle the unhealthy belief in your mind more effectively. Everyone has a different state of belief and personal values, and some are lucky to have positive and healthy beliefs about themselves, to begin with. According to science, affirmations will be effective for those people.

But for those who have more cynical beliefs i.e. that they don’t believe they are worthy, it may actually have a negative effect. This might make sense because positive affirmations can be meaningless since they conflict with the beliefs you carry in your subconscious mind.

If you tell yourself something you cannot visualize being true, you probably have to argue with yourself. This, over time, can instill in your belief because the contradiction is what you visualize.

If what you are trying to affirm is incongruent with a deeply held negative belief, the results is an inner struggle.

That’s why I think it is essential to add more context to the financial affirmations you’ll use and try different techniques that suit your financial journey well. Unfortunately, there’s no universal money affirmation, so you’ll have to try and test which one feels right.

To help you create effective money affirmations, here are some tips and techniques to increase the likelihood of ensuring the money affirmation will work for you.

How to make financial affirmations effective?

Even though many research papers have confirmed the benefit scientifically, there are a couple of things we also need to pay attention to when it comes to self-affirmation:

Positive affirmation needs to be paired with action to work.

Affirmation is a step toward change, but not the change itself.

If you say to yourself, “I will be a millionaire in five years.” while making minimum wage, would you believe it? The chances are minimal. You probably feel that’s a lie because you are not delusional.

But if you start reducing your expenses an/or maybe find a higher paying job, affirming yourself, “I will be debt free in five years and actively work towards building my emergency fund.” will resonate much more in your mind. Because you see the progress you made, and the statement is backed with facts.

Humans will be more convinced when we see a behavior change than we see ourselves through our thoughts.

When you combine practicing constructive beliefs about yourself and taking action to make beneficial changes, you will create the optimal result instead of one or the other.

Be curious about your negative money belief.

It is natural to feel that some affirmation feels off base. But before completely disregarding this technique, it might be helpful to question the affirmation first. Particularly for those statements that you feel are 50% true or more.

For instance, when you read this statement, “With careful budgeting, I can afford to travel and buy a house.” How do you feel?

If your first reaction is, “Well.. I live paycheck to paycheck. Thus, I can never afford to travel”. Instead of constantly feeding that statement to your subconscious mind, a better way to handle it might be to question that belief. Get curious and try to tweak the declarative statement to a question.

Do I truly live paycheck to paycheck? Do I only spend on the things that I need and/or love? Is there a room in my expenses where I can reduce them?

Maybe more questions to challenge your negative money belief:

– Am I willing to cut my expenses?

– Can I maybe find a cheaper apartment? Note that the average American spends the most on housing, transportation, and food. If you cut back on those three things, that’s where you are going to get the most significant savings.

– Is it possible to share transportation with my coworker?

– Can I try to downsize your apartment or take on a roommate?

– How about if I start cooking at home and do not order takeout as much? While cutting my expenses, can I upgrade my skills to find a better-paying job?

Maybe also try to review your expenses and credit card statements; you may learn that you can save $100 a month by canceling unused subscriptions. Then, the new belief might shift into “With careful budgeting, maybe I can afford travel and a house.”

Use maybe

For those who struggle with intrusive thoughts and self-hatred, try to use a “maybe” statement that might feel more realistic. This can be the first turning point to getting into the habit of believing in positive affirmations.

For instance, maybe you pick a positive affirmation, “I am in control of my finances” to combat the negative thoughts, “I fear my finances.” But instead, you feel overwhelmed because the reality is that you have student debts, car payments, and rent due. Try to insert maybe in the statement and see how you feel. “Maybe I have control over finances.”

Try to challenge this belief and bring some facts into this statement. Do you have a stable income coming in? Can you find a higher-paying job? Are there any rooms in your expenses you can cut?

The “maybe” financial affirmations and thoughts process can be easier to believe. Additionally, it may make you feel better because you are not setting yourself up for unrealistic expectations. You are simply opening up the possibility to accept that you are not your thoughts.

Visualize yourself doing the work

Visualize yourself taking the steps and doing the work. Feel what it feels like in your body to do the work. For instance, visualize yourself closing that amazon shop when you feel tempted to do stress shopping online. Or, visualize yourself talking to your boss and asking for a raise.

Ask yourself two questions:

– What challenges you are likely to face? This helps you anticipate friction.

– Plan your solution by creating an if-then plan. For instance, if you feel tempted to spend money, you will grab a phone and call your mom instead. So, if something happens, then I will do something.

Commonly, you might feel cautious when you have to imagine yourself taking the steps toward the financial goal you always wanted. You may project your past experiences and fears toward the challenges and opportunities. In other words, you may start imagining things that could go wrong and arguing against yourself.

But if you use someone else, you may find yourself bold and creative and immediately see more possibilities and opportunities. Chances you probably have told someone to do it. For instance, maybe in the past, you told your friend to get that dream job, negotiate your salary or maybe ask for a raise.

This is called the power of objectivity. Instead of visualizing yourself, replace yourself with someone else. Even better, someone else you admire. It helps remove the fears and biases you have toward the challenge.

If you have trouble visualizing yourself doing the work, ask yourself, what would your friend do?

Financial affirmations work when you are focused on your value

According to self-affirmation theory, your affirmation will likely be more effective when it reflects your core personal values. If you don’t know what core personal value is, it is a list of qualities representing your highest priorities and defining your choices. Personal values stem primarily from social and environmental factors such as your family, education system, and the culture you grow up with.

For instance, if one of your personal values is being wealthy, you may be ok with working longer hours and sacrificing your work-life balance. But it is probably the opposite with someone with family or wellness as their core value.

Another example is if one of your values or strengths is persistence, you could say something like, “every day, I work towards paying off my debt. I’m being persistent with my financial goal”.

Here are some personal core values to inspire you:

- Authenticity

- Integrity

- Gratitude

- Courage

- Family

- Growth

- Frugality

- Adaptability

- Well-being

- Assertiveness

- Kindness

- Creativity

- Curiosity

- Persistence

- Modesty

- Self-discipline

- Honesty

Financial affirmations are more effective when you are being authentic and specific

Additionally, more neutral and specific statements, such as “Every day I work towards landing 6 figure income by taking more classes, expanding my network, and working on my interview skills, ” would be more helpful.

For instance, if you use too broad affirmations such as “I love my gorgeous body” or “I earn six figures income” often fail because most people have a hard time believing those things unless that’s already true in your case.

Even worse, if you make minimum wage and have bills overdue, saying “I am rich” may actually remind you how broke you are.

When you are being specific and focused on your value with your affirmation, the affirmation is more likely to work. It is essential that as you read or write them, you want to feel that it is authentic and you don’t feel that you need to judge or argue with it.

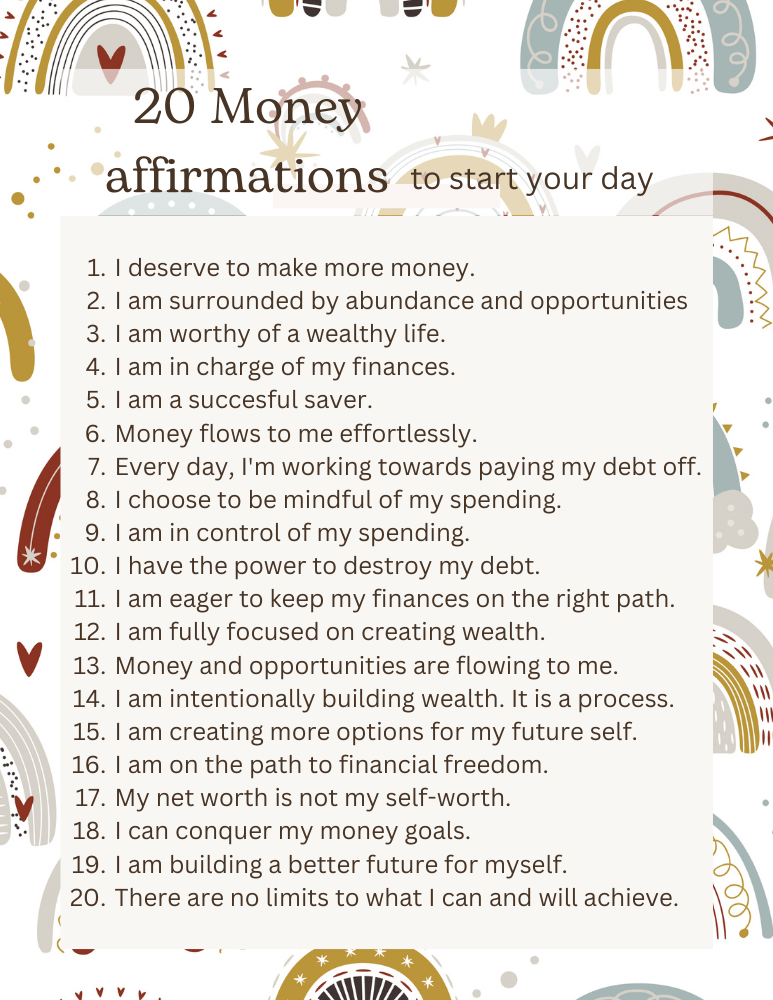

The best way is usually when you come with your own financial affirmations. But if you want ideas, here are some. Remember that these money affirmations can come across as off-based because they might be for someone who is on a different journey. Pick a few that fits your financial goal best and feels authentic to you.

I’d suggest scoring them from 1-10 as a believable score. Discard for anything that’s less than 5 or reword it, such as adding your core values, be more specific, or use maybe as necessary.

Financial affirmations for manifesting money and earning it

#1 I deserve to make more money.

#2 I have the time to make my financial dream a reality.

#3 Every day, I am developing a powerful wealth mindset.

#4 I am surrounded by abundance and opportunities.

#5 Money is a tool to improve my life and make a positive change.

#6 I deserve a prosperous and abundant life.

#7 I trust the universe and my ability to generate wealth and have the lifestyle I want.

#8 I put my best effort into making wise financial decisions.

#9 I am worthy of having and making more money.

#10 With my financial knowledge and grit, I’ll create abundant financial wealth for myself and my family.

#11 I am in charge of my finances and will create more wealth.

#12 I can earn a lot of money and create wealth abundantly.

#13 Wanting more money doesn’t make me a bad person. It means I am being proactive and financially prepared for the future.

#14 Every day, I commit to my finances by consistently managing my money and investing.

#15 I deserve to be paid accordingly to my skills, time, and knowledge.

#16 More money is coming into me because I am looking after my money.

#17 I am a succesful saver.

#18 Money flows to me effortlessly.

Financial affirmations for debt-free life

#1 I am intentionally paying off my debt and choosing a debt-free life. It is a process.

#2 With a plan in hand, I feel in control of my finances.

#3 Every day, I’m working towards paying my debt off.

#4 I choose to be mindful of my spending and expenses.

#5 Debt-free life is more than possible. With the financial plan in hand and me being patient, I have the power to make it happen.

#6 With my hard work and creativity, I can become debt-free.

#7 I’m not controlled by my debt. I am managing it.

#8 I am in control of my spending.

#9 I have the power to improve my relationship with money.

#10 I am building my financial self-discipline every day to get the kind of financial life I want.

#11 I have the self-discipline to delay my shot term gratification to have an easier life in the future.

#12 I have the power to destroy my debt.

#13 I show up by tracking and saving my money.

#14 I am sticking and committed to my monthly budget.

#15 I am ready to take steps toward a brighter financial future.

#16 I want to get the confidence that I’ll get out of this debt. I am learning to trust myself by taking small step each and every single day.

#17 I want to believe I can get out of this debt. I’m working toward believing in myself. I’m trying every day to control my spending and think more positively about myself and my capabilities.

#18 I am eager to keep my finances on the right path.

#19 Every day, I commit to my finance by managing my money and investing consistently.

#20 I get to decide what to do with my money. I control my money. I am in charge.

#21 I can look at my finances without fear. I am in control of my financial destiny.

#22 I give myself grace and am patient to pay off this debt.

#23 With the consistent effort that I’ve put in, I can see myself at the finish line.

Financial affirmations for financial freedom and abundance

#1 Money buys me freedom. Freedom from stress and abuse, and freedom to travel.

#2 I have the plan to be financially free and patiently execute it every day.

#3 I am dedicated to make my financial freedom a reality.

#4 I am fully focused on creating wealth.

#5 My money is working hard for me.

#6 I am thankful for the abundance of money in my life.

#7 I can be wealthy.

#8 I am on my own financial path and will not compare myself to others.

#9 I am grateful for every dollar in my bank account.

#10 Money and opportunities are flowing to me.

#11 My net worth is not my self-worth.

#12 I allow money to flow to me easily and unexpectedly.

#13 I am intentionally building wealth. It is a process.

#14 I have the power to create success and build the wealth I desire.

#15 With careful budgeting, I can make my financial dream a reality.

#16 I am creating more options for my future self.

#17 I am thankful for my past self for being consistent and disciplined in my financial endeavor.

#18 I am building a better future for myself. My future self will thank me for being consistent.

#19 I am grateful for all the money that I have now.

#20 Every dollar saved puts me closer to financial freedom.

#21 I am on the path to financial freedom.

#22 I am in charge of my financial abundance and growth.

#23 I am actively working on my financial freedom, so I don’t have to think about money someday.

#24 I’m in charge of my financial success.

#25 I am being disciplined and consistent with putting my investment (every month), (every week)

#26 I know I’m on the right path, and I’m willing to keep saving and investing, and eventually, I’ll achieve my financial freedom.

Financial affirmations to build your confidence

Did you find yourself struggling to find things about yourself to affirm? If yes, it’s ok. You could start with a statement about what you want to believe.

#1 I am frustrated by my spending habit, but I am learning to treat myself with the respect I deserve. I am learning to do better.

#2 I am overwhelmed with the fact that I have a lot of debt. but I’m learning to improve my finance each and every single day. I’m learning to do better.

#3. I am scared about handling my finance, but I’m learning to have confidence in my ability to build better financial future. I am learning to do better.

#4. I want to believe that I’m capable enough to handle my finance. I’m working toward believing in myself. I’m trying every day to take small actions and challenge my belief about myself and my capabilities.

How to use money affirmations

I’d recommend starting small, for instance, a few times a week. Pick anytime that you feel comfortable and fits your schedule best. Morning, night, or noon. Generally, it is a good practice to pick the same time. That way, you can start building a routine and habit for yourself.

If you meditate or practice breathing work, you could also incorporate it into your practice if you’d like. If you journal, you can also write a few affirmations in your diary. Maybe play calm music in the background or make yourself a cup of tea to set the mood.

Here is my favorite meditation music video you could check out.

You could also do it when you get ready in the morning. Repeat one or two affirmations while doing your skincare routine or when brushing your teeth. This is called habit stacking. Essentially, you add a new behavior on top of your current habit. It increases the chances you’ll do the affirmation because you have the current habit as a reminder.

If your schedule is tight, you could also do it during lunch. Take five or ten minutes. Remember, when you start to doubt yourself, write 3-5 facts that justify the statement or start being curious about it. If you are still arguing with the statement, reword it or discard it.

Don’t forget to thank yourself at the end for bettering yourself 😊

Don’t underestimate the power of doing 10 minutes of simple exercise daily. Short-term, they can break your negative thought cycles. Over time they can become mighty 💪.

Can financial affirmations make me rich?

I wish that’s the case, but if it that’s easy, then everybody in this world will be prosperous and wealthy. To be rich, usually, is the combination of a few things, such as hard work, luck, and talents. But affirmation could help people believe in themselves, which is the first step. Because they believe in themselves, they start creating plans and taking small steps consistently to make things happen.

What is the money mantra?

Both affirmation and money mantras are generally used to shift your belief and make you more confident in reaching your financial goal. Mantras are typically shorter because they might be used throughout your mediation. But generally, they serve the same purpose.

My seven favorite financial affirmations that I find helpful and impactful

#1 There are no limits to what I can and will achieve.

#2 I am grateful for the money I have.

#3 I am surrounded by opportunity.

#4 Every day, I am building a better future for myself. My future self will thank me for being consistent.

#5 I am on my own financial path and will not compare myself to others.

#6 My net worth is not my self-worth.

#7 The goal of having a lot of money is not to think about money.

#8 I have enough. I am enough.

Financial affirmations summary

In summary, financial affirmations, or affirmations in general, can help boost your perseverance to achieve your goal. But also to increase the effectiveness, make sure that they are believable, align with values, and it is paired with consistent action. When our choices and actions align with our values and what we want to believe, it will feed back to our minds, thus strengthening our belief system.

Vi, a software engineer with a keen interest in personal finance, had planned to retire once she reached her lean FI/RE (Financial Independence/Retire Early) goal. However, after achieving the goal, she took few months of a mini-retirement filled with travel and adventure and decided to continue her career.

For the past five years, Vi has been using Personal Capital (Empower), a free financial tool. Her favorite features include the dashboard for net worth, allocation, and planning, which help track her FI/RE goal and keep those investment fees in check.