Are you eager to save money for a special goal, but unsure where to start? I was in school debt before and unsure where to start building an emergency fund. I created this 52-week money challenge for those who might feel the same. Sometimes it can be overwhelming, and I think this will make saving feel more enjoyable and fun!

Related article:

- 13 ways to drastically cut your expenses

- No spend challenge (PDF Printable)

- 11 questions to ask yourself before buying something

- 100 ways to save money

What is the 52-week money challenge?

The 52-Week Money Challenge is a savings plan designed to help you start small and gradually increase your savings over a year. By following this money challenge, you can build a new habit of saving before spending, aligning with the wisdom of investing legend Warren Buffet,

“Do not save what is left after spending; instead spend what is left after saving.”

The idea is simple: you start saving x amount of dollars in the first week of the year, then gradually increase your savings each week throughout the year.

After a few months, you’ll be able to look back and feel the satisfaction of how much you have saved. You’ll feel proud that you took on this journey and stuck to it. Without realizing it, you will build an emergency fund and FU money.

How does the 52-week money challenge work?

Here are the steps:

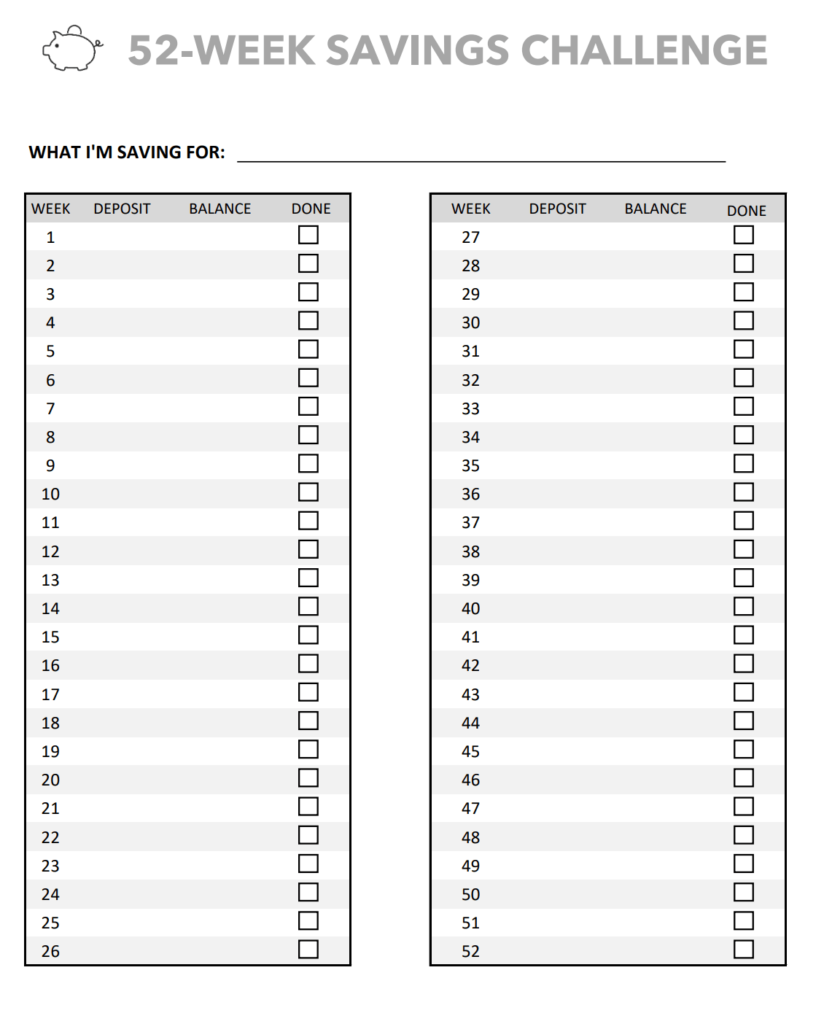

- Get the Chart and Set Your Goal: Download the 52-Week Money Challenge Printable and write down your savings goal. Whether it’s a dream vacation, an emergency fund, or simply building better money habits, having a clear goal will motivate and guide you throughout the journey.

- Choose a Plan: The challenge offers different plans, each with a specific savings target. Here are some options:

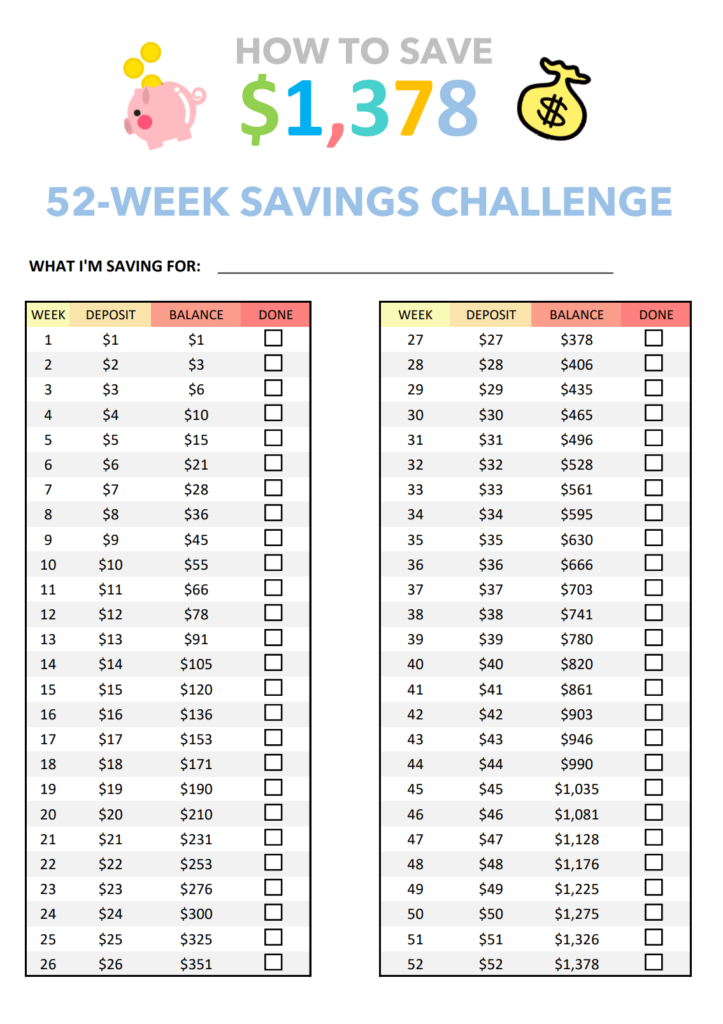

52-Week Money Challenge Printable – Save $1378

You start by saving $1 in the first week and increase the amount by $1 each week for 52 weeks. By the end of the year, you’ll have $1,378 saved up!

This is a great option if you have trouble starting. Everyone has to start somewhere, and starting small is a good way to make progress.

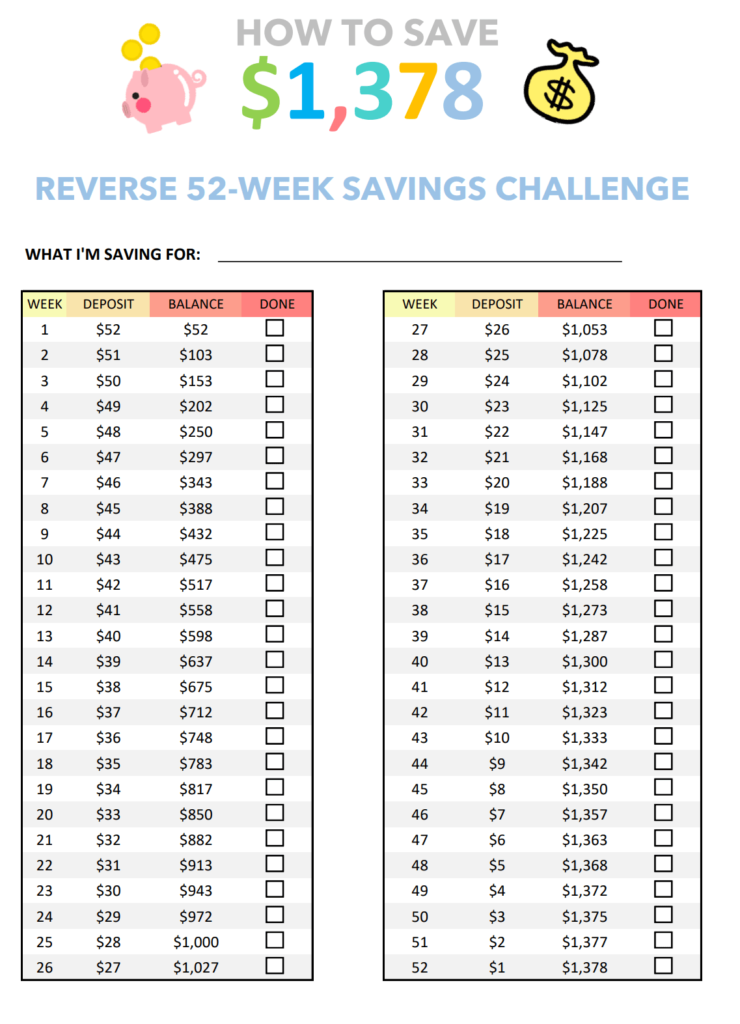

Reverse 52-Week Money Challenge Printable – Save $1378

In this version, you’ll do the heavy lifting first, starting with $52 in the first week and decreasing the amount by $1 each subsequent week.

This is a great option if you have the money upfront and tend to spend more at the end of the year. The reverse 52-week money challenge may make more sense to some people because we usually spend a lot more during the Christmas season.

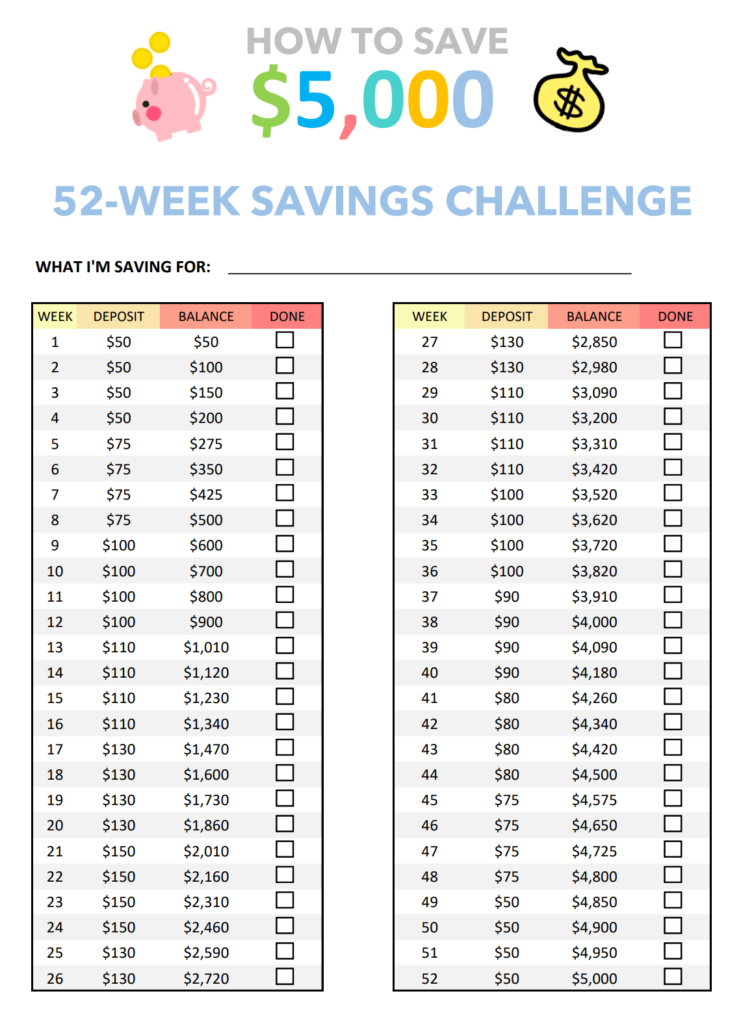

52-Week Money Challenge Printable – Save $5000

If you’re feeling more ambitious, check out this challenge to save $5,000 or even $10,000 in a year.

You can fund an IRA/Roth IRA at the end of the year!

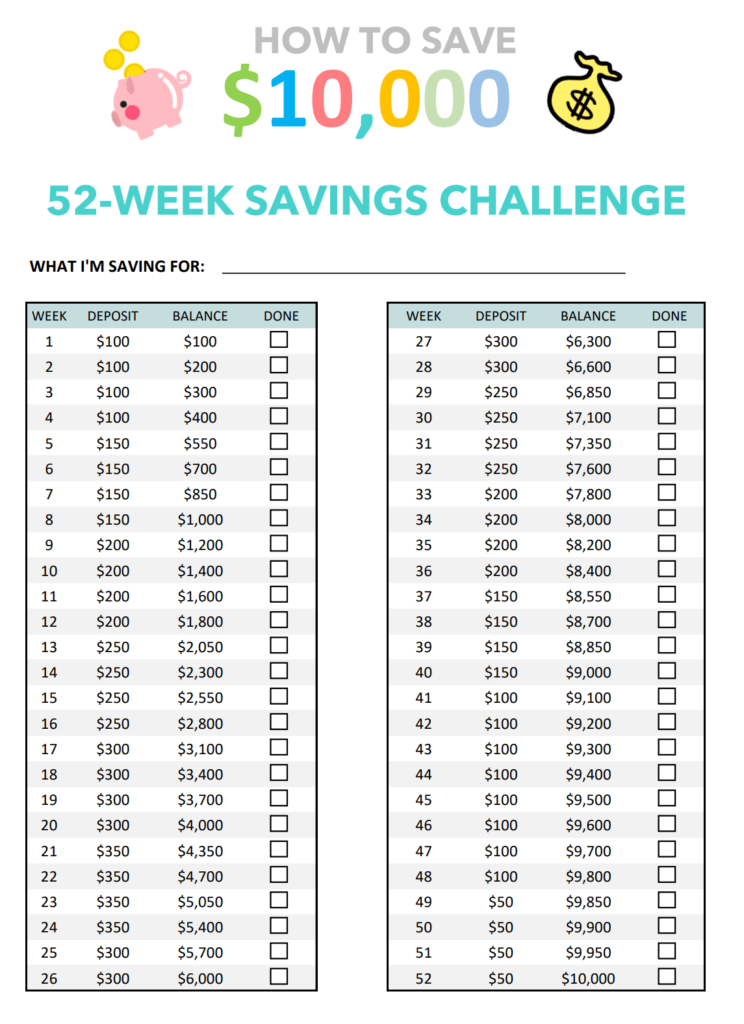

52-Week Money Challenge Printable – Save $10,000

52-Week Money Challenge Printable – Custom Challenge

If you have a specific savings amount in mind, the customizable plan allows you to create a challenge tailored to your needs.

Why does a 52-week money challenge work?

- 52-week money challenge gives you a sense of direction and a concrete plan. It provides visual representation of your progress, which can be highly motivating.

- Setting aside a small amount each week feels more manageable than trying to find a large sum monthly.

- Gamification: treating saving money as a game makes the process enjoyable and keeps you engaged.

Who should use this challenge?

Anyone who wants to start to save, look for fun ways to save money or build a healthy money habit. If FI/RE (Financial Independence Retire Early) is one of your goals, then this can be a good start.

When should you start?

Start whenever you feel comfortable to do this challenge. The sooner, the better. Even if you read this post at the end of the year, you can still set aside the weekly money. Then, use the sum of savings for the remaining weeks as your goal.

“The best time to plant a tree was 20 years ago. The second best time is now.” 😊 – Chinese Proverb

What can you do with your savings?

The beauty of the 52-Week Money Challenge is that it opens up numerous possibilities for your savings.

– Build up an emergency fund: Having an emergency fund can ease financial stress during unexpected expenses. Aim for 3-6 months’ worth of living expenses. Cutting unnecessary expenses is a great starting point.

– Contribute to 401k. Increase your contribution and take advantage of your employer’s 401k match. It is free money!

– Open an additional retirement account. If you have maxed out your employer match – open an IRA/Roth Ira. As of this writing, you can contribute up to $6,000 a year.

– Pay off your debt (student loan, credit card debt, etc). Most people dislike having any debt – paying off your debt will relieve your emotional discomfort.

– Build your F U money – F U money means you have enough money to live comfortably without working full time (or working at all). It allows you to leave your employer when you can’t deal with them anymore. While an emergency fund can sustain you for a short time, F U money will last you longer (at least one year or longer).

– Build your vacation fund – Are you eager to explore diverse cultures and visit uncharted lands? Consider channeling your funds towards a dedicated vacation account.

– Consider investing in yourself. Embarking on a side hustle or obtaining a certification can often be the most rewarding investment you make in your career journey.

Where Should You Keep Your Savings?

Depending on your goals, consider these options:

- If you are saving for an emergency fund or using it for upcoming purchases – I’d recommend putting it in a high-interest online saving account. Not only you’ll earn a higher interest rate, but it is also harder to withdraw the money, so you’ll feel less tempted to spend it.

- If you are saving for retirement, then the options are 401k/IRA/Roth IRA.

Check out this flowchart to learn how to prioritize spending your money.

How do I find ways to save more money?

Here are some ways to save money with minimal pain:

- Find cheaper phone bills

- Budget your eating out and online shopping

- Cut your unused subscriptions

- Negotiate your bill (cable, credit card fees, car insurance)

- Replace your cable with cheaper online streaming services

- Budget your spending

- Share your subscription with friends (i.e. amazon prime, Netflix)

- Sell your old stuff

- Buy groceries at cheaper market chains such as Aldi.

- Sign up for cash-back apps, such as Rakuten and CapitalOne Shopping.

- Cash-only approach: For social outings, bring cash to avoid overspending.

- Accountability partner: Invite a friend to join the challenge and hold each other accountable. The personal finance groups I’d recommend joining: Women’s Personal Finance (Women On FIRE) and Personal Finance on Reddit.

For more tips and ideas on saving money, check out the posts below:

How to stay motivated?

It is easy to give up when you can’t meet the challenge 100%. If you cannot find the weekly target, it’s ok! Add whatever amount you can each week. Every dollar counts!

Inviting your friend to join the challenge can also help you to be accountable partners.

If you tend to shop for fun (like I used to) – it helps to set up your environment intentionally – here are a few ideas:

- Uninstall any online shopping app (or you can turn off the notification)

- Unsubscribe from online shops

- Download a web plugin to block online shop sites, such as blocksite

- Bring cash only when going out with friends

More ways to stay motivated:

- Join a supportive community: Engage with like-minded individuals participating in similar challenges. Being part of a supportive community can provide encouragement and valuable advice.

- Visualize success: Imagine completing the challenge and visualize the positive outcomes. This mental imagery can boost your motivation and confidence.

- Find inspiration: Seek inspiration from others who have completed similar challenges or have achieved remarkable feats. Follow their journeys and learn from their experiences.

Final Takeaways

The 52-Week Money Challenge Printable provides a fun and effective way to cultivate a savings habit. No matter where you start or how much you save, remember that every dollar counts. Embrace the challenge, and by the end of the year, you’ll be amazed at the progress you’ve made toward financial security and a brighter future. Happy saving! 😊

Vi, a software engineer with a keen interest in personal finance, had planned to retire once she reached her lean FI/RE (Financial Independence/Retire Early) goal. However, after achieving the goal, she took few months of a mini-retirement filled with travel and adventure and decided to continue her career.

For the past five years, Vi has been using Personal Capital (Empower), a free financial tool. Her favorite features include the dashboard for net worth, allocation, and planning, which help track her FI/RE goal and keep those investment fees in check.