Do you struggle to save money? Are you trying to build healthier money habits? No spend challenge printable may be worth checking out.

I wrote this post after Christmas and spent a lot on gifts, online courses, and shopping items. I get very spendy towards the end of the year, and it can bleed over easily into the new year, and I want to reset that habit.

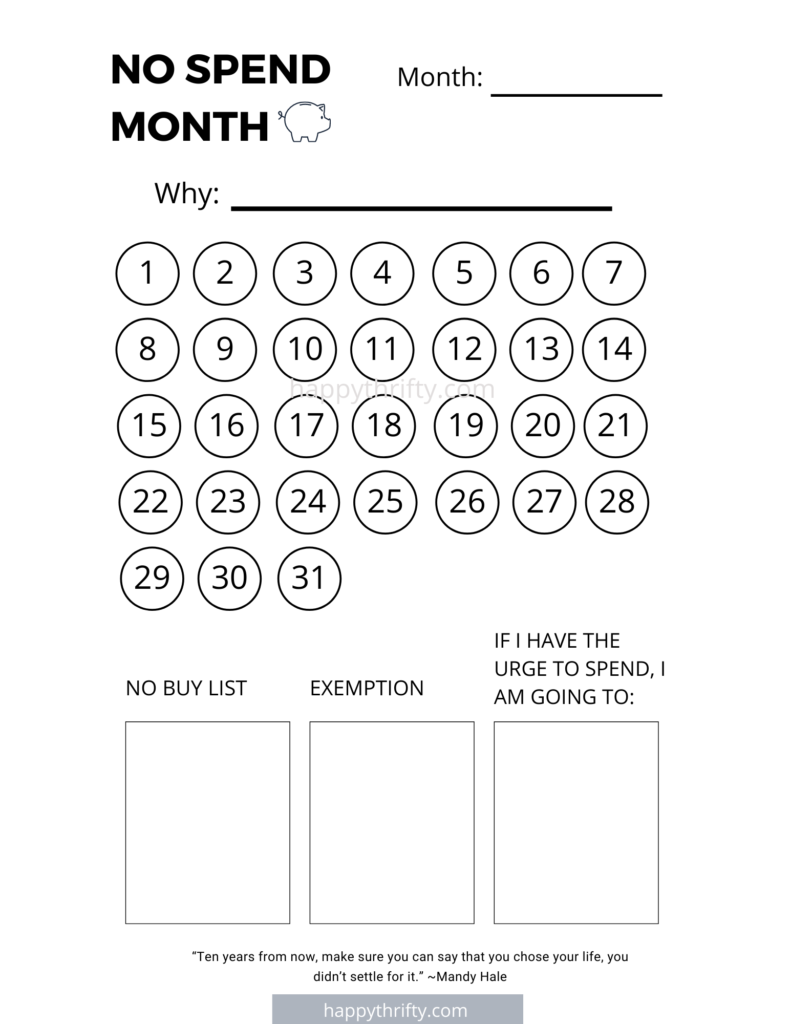

If you are like me, using a no-spend challenge can be a great way to break your overspending habit and start fresh on your finance journey. Download this printable/tracker that will be helpful for you.

Note: If you are looking to improve your finances – check out these posts:

99 easy and realistic ways to save money

11 questions to ask yourself before purchasing something

What is a no-spend challenge?

No spending challenge essentially means no spending on certain things during a period. You set your own rules and no spending money on a “want” item that you will decide.

For instance, if you tend to overspend on clothing like me – this can fall into the type of no-spend item.

Items such as clothing, new shoes, new make-up, bags, eating out, home décor, tech gadgets, and food takeout are worth considering as a no spend item.

However, you generally want to keep necessary items on the same spending level, such as groceries, food, gas, rent, heat, and insurance. Additionally, you want to keep the plan realistic so you can stick with it.

During this no spend challenge, you may find yourself with more time to fill in and this may lead you to find a new hobby. If you have no found one yet, I’d recommend signing up for a free 14 days skillshare premium class to find one.

Why do you want to do a no-spend challenge?

No spend challenge can:

- Break your overspending pattern and build a better money habit.

- Build momentum and belief that you can stop living paycheck to paycheck

- Cut expenses and help you realize that you don’t really need those extra items and can use what you’ve got.

- Build your awareness and the ability to keep yourself disciplined and avoid spending unconsciously.

The why can be different for everyone. To make it more specific and concrete, you can write your financial goal in the tracker – for instance:

- I am saving money for my trips to Japan.

- I want to pay off my student loan debt and build my wealth.

- My goal in the next six months is to build an emergency fund.

- I want to have my FU money so I can walk away from my job temporarily when necessary.

- Achieving financial freedom is my ultimate journey because I am sick of corporate life.

Write down your motivation in a note and put it in visible places, for instance your fridge, so you are always reminded in the morning.

How do I do the no-spend challenge?

First, you would need to decide on three things:

- The no-spend list

- How long do you want to do the challenge?

- What to do when you have the urge to spend?

How do I pick the no-spend items?

You probably already have a few items in your mind that you tend to overspend. But if you don’t, looking at your credit card transaction is a good start. From there, you may notice your overspending pattern. Did you regret buying certain items? Or did you find those items are not being used?

As a general guideline, pick items that are a “want” and start with things you tend to impulse buy. When you want to buy something, it is good to identify as one of the four buckets:

- Need. These are critical items for everyday life for you and your families, such as food, housing, utilities, and healthcare.

- Love. These things will bring you joy for the long term, something that you genuinely love. For instance, something you can remember, such as vacation, home, or maybe a nice kitchen. Many people skip over the love because they want that short-term gratification, or maybe they never thought they could afford it.

- Like. This is something that will bring you joy for less than six months.

- Want. This is a purchase that satisfies you temporarily. Usually, it is bought when you want to relieve stress temporarily.

Those in the want bucket are typically good candidates for no-spend items.

Examples:

- Restaurants

- Takeout food

- Clothes

- Beauty/skincare products

- Home décor

- Electronic

- Tech gadgets

- Kitchen Appliances

- Pieces of jewelry

- Scarves

- Shoes

- Accessories and knick-knacks

- eBooks (I am guilty of this too)

Necessary items that you want to keep:

- Rent/mortgage

- Phone service

- Internet

- Groceries (if you overspend on this category, try to plan your meal).

- Utility bills such as gas, heat, and electricity

- Insurance

- Planned items

- Emergency items

When it comes to picking the no-spend item – balance is the key. If you truly enjoy your subscription, like Netflix maybe, (I have a piano subscription, and I truly enjoy it) – I suggest keeping it but still sticking to the budget and picking different item categories to be on the no-spend list.

Once you master the basic principle, you can increase the difficulty level slowly or/and prolong your no-spend period.

- Level 1: no shopping for certain items. If you have been eyeing a new gadget on Amazon, you can add it to your wish list, put it off for a few months, and you may find yourself forgetting it, or no longer want it.

- Level 2: no spending at all unless it is necessary. For instance, if you have the urge to order takeout, you will check out the fridge and pantries and see what you can create. This will help clean out your deep freezer and pantry. If you are tempted to buy new shampoo, you will go to the bathroom and use the shampoo that’s half used until it is gone.

I am personally guilty of this. For instance, I love trying out new shampoos. As a result, I found a bunch of half-used shampoo bottles when cleaning up my bathroom. Thankfully, I am in the process of using these up before buying new ones.

If you tend to overspend in the necessary categories, such as groceries – trying meal planning will help. For instance, you can make a list of your meal in the next three days instead of mindlessly picking items in the store. Scanning your fridge and pantries before making the grocery trip also helps.

Related post: 40+ cheap food to buy when you’re broke.

If you want to improve your savings significantly, combining a no-spend challenge and reduce your expenses such as changing a cheaper phone plan is a bulletproof way to increase your savings.

How long should I do a no-spend challenge?

If you are starting – I’d recommend doing it for two weeks to start flexing your spending muscle. Then slowly increase the time frame, such as a month.

Time frame selection ideas:

- A week

- Two weeks

- A month

- Three months

- A year

Then start slowly increasing the time frame, such as two weeks and a month. The longer you do a no spend, the more money you can save, and the more solid your new habit is.

But at the same time, you also want to set a realistic goal to keep going. So, if you are not very confident, starting small with one week or even a weekend is no shame. It is essential to start small so that you can build momentum.

How to increase the likelihood of accomplishing this challenge?

It is essential to have a plan. You are 1.2-1.4 times more likely to achieve your goal when you are writing things down.

After you have decided on the time frame and the no-spend list, you want to create a plan of what you will do if you have the urge to spend, which is very likely to happen.

One of the main reasons why a new habit fails is because of a vague plan. The more specific your plan is (don’t make it too complicated though), the more your brain will trust it.

Here are a few ideas to consider:

- Wait for 60 minutes

- Look at your bank account balance/credit card account (pain can be a great motivator).

- Add it to a wish list (if you shop on Amazon, or jot it on paper)

- Search on google “[items you want to buy]” alternatives

- Look for free items on Craiglist or Nextdoor.

- Do other things instead, such as watching Netflix, making yourself a cup of tea, or calling your friends instead. These are some ideas.

It is also beneficial to identify when your urge to spend usually appears. Where were you, and what was your emotional state? Does it happen when you are bored? Does it happen after work? Maybe you hate your job and want to alleviate the stress by shopping around. As a side note, retail therapy works because it gives you a sense of control and distracts you from your sadness. Check out this post to understand how habits are formed in more detail.

For instance, this usually happens when I procrastinate on the things that matter to me, such as writing on this blog and creating music. When the urge to shop on amazon appears, I’d force myself to work on my current task for only five minutes. If I still have the urge, I’d take a break and watch Youtube instead or call my mom. If the item still pops into my head, I’ll go to Amazon but only add them to the wish list. In most cases, I no longer want the item after waiting for it for a few days.

Before buying, it is helpful to evaluate your purchase. Consider writing some of these questions down on a note and sticking them on your computer or wallet.

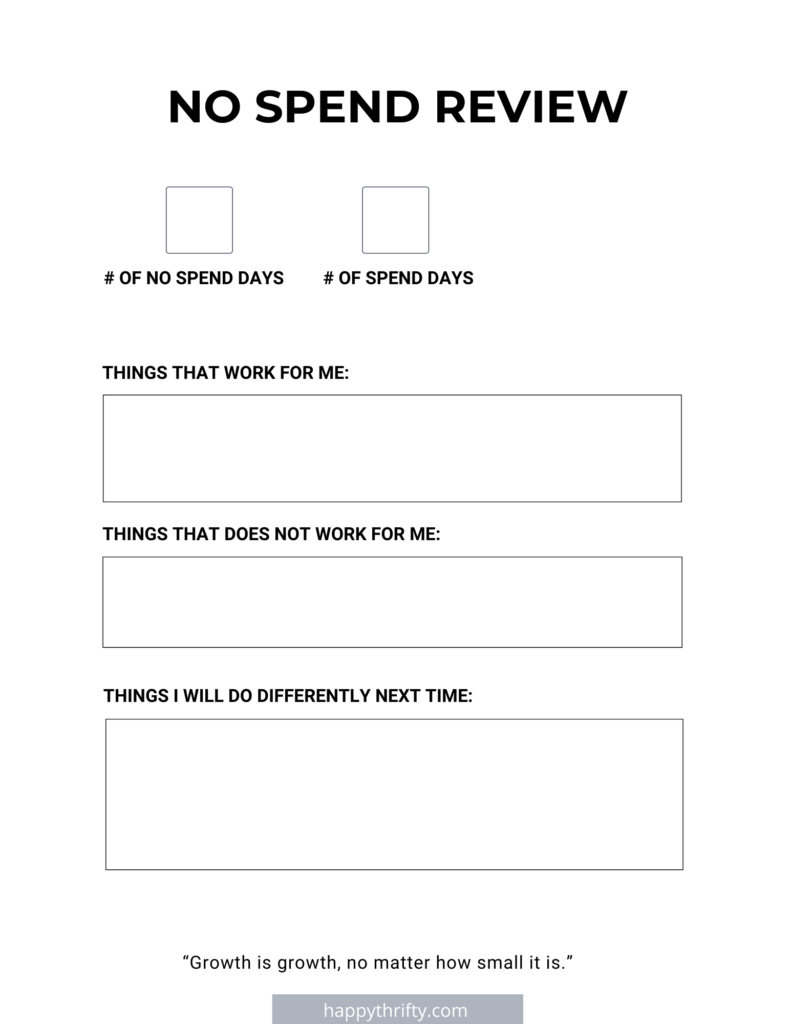

You would most likely want to experiment with a few things if it did not work immediately. For instance, if watching Netflix does not distract you from your urge to shop, try to call your friends or family. Repeat until you find something that works for you.

Tips 💡: Deferring your purchase increases your likelihood of not spending the money.

The goal is eventually to replace your old habit (spending money impulsively) with the new habit (an activity that does not cost you money).

When you create a plan in advance, i.e., if you want to buy, then do something, you’ll increase the likelihood of planting that habit successfully.

Here is a helpful checklist:

- Download the tracker, print it, and fill it out.

- Create a specific plan for what to do when you are urged to spend.

- Don’t set an unrealistic goal. For instance – no spending at all except for what is necessary for a year. Depending on your preference, this may cause fatigue and cause you to give up early. It’s okay to spend on things you like or want once in a while!

- Setup your environment intentionally – for instance:

- Uninstall any online shopping app (or you can turn off the notification)

- Unsubscribe from online shops

- Download a web plugin to block online shopping sites, such as block site.

- Reduce your time on social media if you tend to impulse-buy on ads.

- Bring cash only when going out with friends.

- Don’t go to Target for grocery shopping (because you may find yourself hanging out in the clothing rack) – go to Aldi instead.

- Tell your friends and your family (only if you feel comfortable holding yourself accountable)

Things to do in your free time or when you are bored

Instead of shopping around when you have nothing to do, you can substitute that with activities that are more productive.

If there are any skills you always want to learn or new activities you always want to do – this can be a great start. I try to use my free time to work on this blog and practice piano skills.

Check out these free (or almost free) things to fill your spare time.

27 things to do when you are bored or broke

Outdoor activities

- Go for a hike

- Ride a bike

- Take a walk

- Visit a local animal shelter

- Play a video game

- Get a free gym pass

- Go to a free local event

- Go to free museums

- Walk your dog

Indoor activities

- Visit a local library

- Declutter your room

- Sell your old stuff

- Create DIY gifts

- Cook at home / learn new recipes

- Plan for your next vacation

- Reach out to your friend or family member

- Exercise at home

- Watch Netflix

- Watch funny Youtube videos

- Bake

- Take a shower/bath

- Invite your friend

- Do something you loved as a kid

Self-improvement activities

- Take free online classes to find out about new hobbies.

- Listen to an audiobook

- Create a bucket list

- Play a musical instrument

- Learn a new language (check out Duolingo)

- Watch TED talk

- Figure out your dream career, or spend your time and efforts to get a better job

Self-care activities on a budget

- Take a warm bath

- Make yourself your favorite tea

- Listen to calm music

- Take a nap

- Create a gratitude list

- Meditate

- Light a candle

If you find this post helpful, please share this 🙏

What tips do you have to keep a healthy spending habit? I’d love to hear your thoughts. Thanks for stopping by! 😊

Vi, a software engineer with a keen interest in personal finance, had planned to retire once she reached her lean FI/RE (Financial Independence/Retire Early) goal. However, after achieving the goal, she took few months of a mini-retirement filled with travel and adventure and decided to continue her career.

For the past five years, Vi has been using Personal Capital (Empower), a free financial tool. Her favorite features include the dashboard for net worth, allocation, and planning, which help track her FI/RE goal and keep those investment fees in check.